Is the Federal Reserve’s tapering on its own enough to beat ongoing inflation?

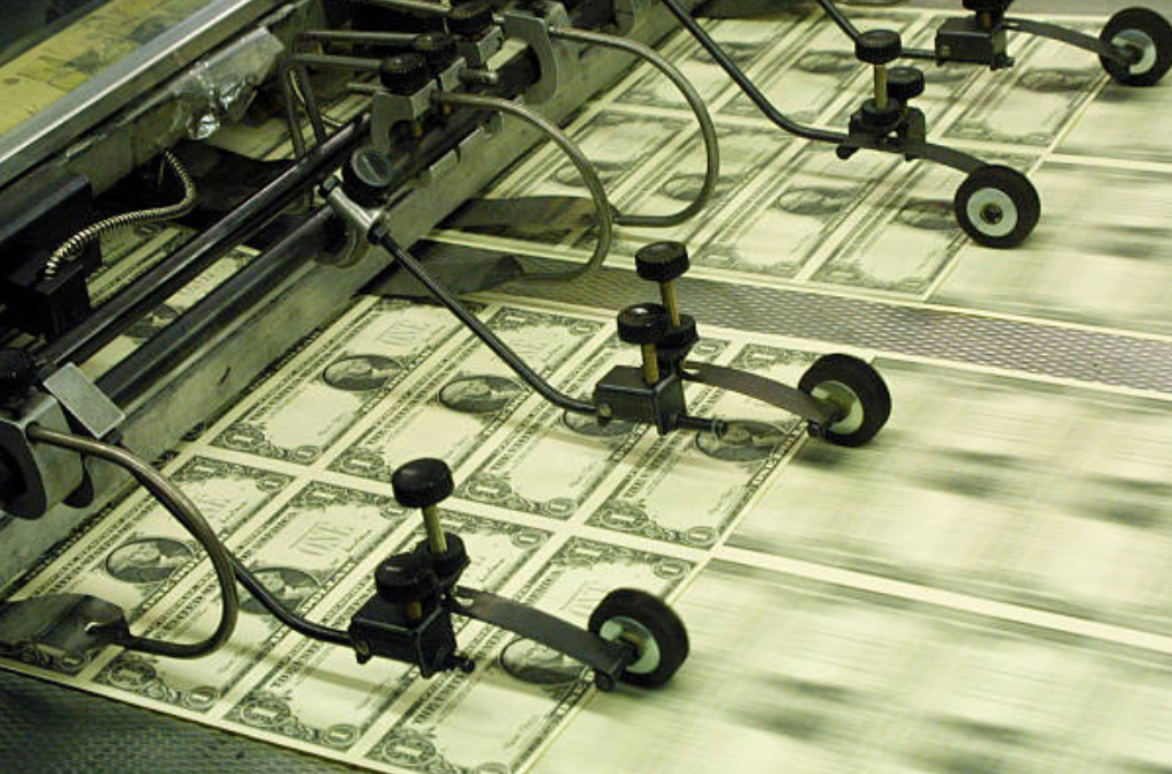

Photograph: Alex Wong / Getty Images

Quantitative Easing during the recession

For the past 18 months, the American Federal Reserve has supported the economy via its Quantitative Easing (QE) policies to stimulate the economy (via increasing money supply) and encourage lending and investments. The American Federal Reserve had announced, in response to the economic shutdown caused by the COVID-19 pandemic, a QE plan of over $700 billion. However, such policies come at a cost as inflation has been surging in the US, and monetary policymakers are debating the level of support the world’s largest economy needs as price pressures begin to extend in multiple sectors such as energy commodities, used cars and raw resources (ex: meat)

Tapering to slow down ongoing inflation

The Federal Reserve announced on November 2nd that it would begin its ‘tapering’ strategy; meaning that the US Federal Reserve would be scaling back its $120 billion monthly bond-buying program later in November, but it would not raise interest rates yet. While industries and financial markets welcome such policies, they might prove to be inefficient on their own in the fight against inflation. To know if the policy implemented by the US Federal Reserve will work efficiently, we need to know what is responsible for the ongoing inflation in the US. I argue that the tapering program in itself is not enough to fight inflationary pressures.

Supply-side inflation

While the money supply increased drastically over the last 18 months, the velocity of money – the average rate of dollar turnover – fell tremendously. People were reluctant to spend their money due to economic uncertainty and instead preferred to save it. The only way for the velocity of money and money supply to increase simultaneously is when money supply and money demand rise at the same time. If this is the case, which it is, the price level is expected to stay the same as prices will only rise if money supply exceeds money demand. Therefore, inflation is unlikely to be due to loose money in the system. Instead, policymakers and businesses look at disruptions to the supply-side. Some of these inflationary pressures stem from shortages throughout the supply chains, on which America depends on to deliver goods and services. On top of disruptions to the supply chains, there has been a soaring increase in consumer demand for goods with limited supplies. Limited supplies with roaring consumer demand for goods mean the market is not in equilibrium. Demand exceeds supply in many sectors as mentioned above, and thus, prices rise to restore equilibrium; the price level has risen in many sectors, such as rents and wages. Furthermore, October was a poor month for the labour market in the US as shown by underwhelming job reports, confirming suspicions that inflationary pressures come from disruptions to the supply side.

The case for ‘temporary’ inflation

The Federal Reserve acknowledged the inflationary pressures on the economy and underscored the severity of supply and demand imbalances. Jerome Powell, the Chair of the Federal Reserve stated that: “supply chain bottlenecks and labour shortages had slowed the pace of economic growth in the country and most companies said they were managing to offset these higher costs by raising their own prices”. The Fed views these factors as playing an essential part in driving pressure upward on prices as they are expected to be “transitory.” The Fed is confident that the supply problems will die down, resulting in prices going down. However, these problems are expected to persist “well into next year”. The Fed also refused to raise interest rates yet. This decision makes sense, especially if unemployment rates are on the rise. The Fed admitted that inflationary pressures were concerning and proved to be more persistent than originally expected and thus, decided to begin its tapering program early. However, I argue that the tapering program in itself is not enough to fight inflationary pressures.

Tapering is inefficient on its own

The Federal Reserve’s average inflation target is 2% and price level growth currently sits at 5.4%. The tapering program put in place by the Fed can help bring inflation down, but the program has a major weakness. Inflation targeting is very sensitive as if the Fed pulls money out too quickly or fails to adhere to financial market expectations, income could fall drastically, and unemployment could rise very rapidly. Unfortunately, tapering does not work efficiently when the economy is constrained by supply rather than demand as tapering targets the wrong problem and it involves multiple risks. Tapering will take money out of the system but will not help fix the supply issues the country is currently facing. The Fed put in place policies to appease the financial markets and ease inflationary pressures while they wait for supply chains to fix themselves or find a long-term solution.

Interest rates on the rise and other possible solutions

All eyes are on the central banks when it comes to inflationary problems, but supply chain bottlenecks are not in the Federal Reserve’s control and thus, the Fed has limited resources to battle against this particular type of inflation. Inflation will elevate for longer as inflation expectations are creeping higher and the deficit in employment is due to a lack of supply, therefore, there are limits on what the Fed can realistically do by keeping interest rates unchanged for so long. The reluctance to raise interest rates also rests with the fact that as soon as interest rates are raised, the US will enter a period of economic slowdown and the Fed will not let that happen until full employment is reached and the economy is in equilibrium to minimize the damages high interest rates will cause.

While the Fed is unable to fight inflation efficiently, the Biden Administration could act by loosening and repealing regulations that make it more costly to produce goods and services and embrace “supply-side liberalism” as this would ease up the pressures on the supply-side of the economy. A spending target could also be used as the Fed could fight demand shortfalls without harming the economy with supply shortfalls. With a spending target, the Fed could tolerate higher prices and absorb some shock instead of forcing down inflation.

In the fight against inflation, it is always important to know where the inflation comes from to use the best resources at your disposal to fix the issue without harming the economy. In this case, the supply-side is to blame for inflation, and appropriate measures are yet to have been put in place as the Fed is reluctant to increase interest rates yet while the government has not mentioned a plan yet. Instead of focusing on what we are doing, we should also look at what we are not doing as it could help us figure out the root of the problem.

On November 30th, Jerome Powell finally described inflation as "stubbornly high". He is therefore considering removing financial economic support at a faster pace. Unemployment is still rising slightly, persistent problems with global supply chains and the discovery of a potentially dangerous new variant leave the door open for an earlier than expected interest rate hike (financial markets have obviously reacted badly).